Live trading in the foreign exchange market demands a sharp set of strategies. Mastering forex technical analysis is paramount to navigate the dynamic and volatile nature of this global marketplace. By analyzing price charts, patterns, and indicators, traders can identify potential trading opportunities and minimize risk. This article explores essential live trading strategies based on forex technical analysis. It delves into popular chart patterns, provides insights into key technical indicators, and outlines a systematic approach to execute trades with precision. Whether you're a novice or an experienced trader, this guide equips you with the knowledge and tools to enhance your live trading performance in the forex market.

- One fundamental aspect of mastering forex technical analysis is understanding common chart patterns. These recurring formations can signal potential trend reversals, continuations, or breakouts. Some prevalent patterns include head and shoulders, double tops/bottoms, triangles, and flags.

- Technical indicators offer valuable insights into market momentum, volatility, and potential trading signals. Moving averages smooth out price fluctuations, while oscillators like RSI and MACD highlight overbought or oversold conditions. Traders can utilize these indicators to confirm chart patterns, identify entry and exit points, and manage risk.

- A systematic approach to live trading involves establishing clear entry and exit criteria based on technical analysis. Traders should define profit targets and stop-loss orders to limit potential losses. Risk management plays a crucial role in forex trading, and it's essential to adhere to a pre-determined risk-reward ratio.

Unveiling the Charts: A Guide to Forex Technical Analysis

Technical analysis functions as a cornerstone for many forex traders. It relies on the study of price charts and trading volume to forecast future price movements. By recognizing patterns and trends, traders can formulate informed decisions grounded on historical data. Critical tools in this analysis encompass moving averages, support and resistance levels, and chart structures. Mastering these techniques empowers traders to navigate the complexities of the forex market.

A successful technical approach often blends multiple indicators to deliver a more comprehensive understanding of market sentiment and potential price action. Traders must constantly evolve their strategies as market conditions change.

Keep in thought that technical analysis is just one piece of the puzzle. It should be used in conjunction with fundamental analysis and risk management practices to create a well-rounded trading plan.

Key Tools for Effective Forex Technical Analysis

Technical analysis is a significant tool for analysts in the forex market. To maximize your chances of success, it's essential to harness the right tools.

Here are some important instruments every forex technical analyst should have:

- Trading Software: This is your primary platform for visualizing price action. Choose a application that offers advanced charting capabilities, including multiple timeframes, technical tools, and drawing utilities.

- Analytical Indicators: These are mathematical calculations based on past price data. Popular indicators include MACD, which can help you detect trends, resistance, and potential market opportunities.

- Economic Calendars: Stay up-to-date on scheduled economic releases that can influence forex prices. These calendars provide valuable information on GDP decisions, which can create movement in the market.

By incorporating these essential tools into your forex technical analysis, you can enhance your understanding of market patterns, and increase your potential for successful trades. Remember that consistent practice and learning are key to mastering the art of forex technical analysis.

Exploring the Power of Technical Analysis in Forex Trading

Technical analysis serves as a powerful tool for forex traders seeking to decipher market trends and identify profitable opportunities. By analyzing price charts, trading volume, and other indicators, traders can gain valuable insights into the psychology of the market and make strategic trading decisions. From identifying support and resistance levels to recognizing chart patterns and momentum indicators, technical analysis presents a framework for navigating the complexities of the forex market.

- Additionally, understanding technical indicators such as moving averages, RSI, and MACD can strengthen a trader's ability to identify potential buy and sell signals.

- Therefore, mastering the art of technical analysis can significantly boost a forex trader's chances of success in this dynamic and challenging market environment.

Technical Analysis 101: Your Blueprint for Forex Success

Embark on a journey into the world of financial speculation and discover how technical analysis can become your ultimate weapon. This comprehensive guide will unveil the strategies behind reading charts, spotting patterns, and executing profitable deals.

Whether experience level, technical analysis provides a system for navigating the volatility of the forex market. Learn to interpret candlestick patterns, understand moving averages, and utilize other powerful indicators to gain an edge in your trading endeavors.

- Gaining the power of technical analysis is essential for any aspiring forex trader who seeks to consistently achieve success.

- This guide will empower you with the knowledge and skills needed to participate in the forex market with confidence.

Forex Technical Analysis Explained: From Basics to Advanced Techniques

Diving into the world of forex trading needs a solid understanding of technical analysis. This powerful tool get more info empowers traders to uncover potential price movements by analyzing past market data and chart patterns. Beginners can start with fundamental concepts like levels, moving averages, and candlestick formations. As your skills evolve, explore more advanced techniques such as Elliott Wave Theory, Fibonacci Retracements, and harmonic patterns. Remember, mastering technical analysis is an ongoing journey that needs dedication, practice, and continuous learning.

- Fundamental concepts: Support, resistance, moving averages, candlestick formations

- Advanced techniques: Elliott Wave Theory, Fibonacci Retracements, harmonic patterns

Barry Watson Then & Now!

Barry Watson Then & Now! Bo Derek Then & Now!

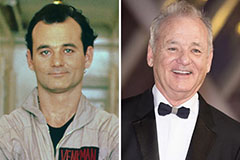

Bo Derek Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!